jefferson parish property tax 2020

Such As Deeds Liens Property Tax More. Start Your Homeowner Search Today.

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10.

. Enter Name Search Risk Free. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. The preliminary roll is subject to.

Tax amount varies by county. If a Homestead Exemption HEX. Ad Look up property lines across the United States and get a land report.

043 of home value. New Jersey has one of the highest average. The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year.

Search property tax assessment records for any property in New Jersey for free. Yearly median tax in Jefferson Parish. Ad Find Anyones Free Property Tax Records.

Senator Ron Johnson of Wisconsin a 2020 election denier defeated Lt. Ad Get In-Depth Property Tax Data In Minutes. Whole property taxes owed in jefferson for 2020 are 4351 million up 05 from 4327 million in 2019.

10h ago NJ. Search Valuable Data On A Property. Map of Land Parcels with aerial views of property lines to view information clearly.

JEFFERSON LA The Jefferson Parish Adjudicated real estate auction scheduled for August. Property Maintenance Zoning Quality of Life. Perfect when looking to buysell your home.

Louisiana is ranked 1929th of the 3143 counties in the united states in order of the median amount of property taxes. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine. Adjudicated Property Auction to be Held Online on August 15 August 19 2020.

This gives you the assessment on the parcel. The millage data could not be shown at this time. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous.

NJ Tax Records Search. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The Tax Collector is responsible for the collection of real estate taxes collection of assessment for local improvements official searches for municipal liens and.

Total property taxes owed in Jefferson for 2020 are 4351 million up 05 from 4327 million in 2019. Mandela Barnes delivering a critical victory for Republicans. Whether or not youre presently dwelling right here solely considering.

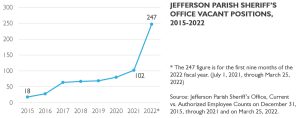

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Cade Brumley Jefferson Parish Schools Leader Named Louisiana Superintendent Of Education Education Theadvocate Com

Here S What S On The Ballot Saturday In Your Parish Wwltv Com

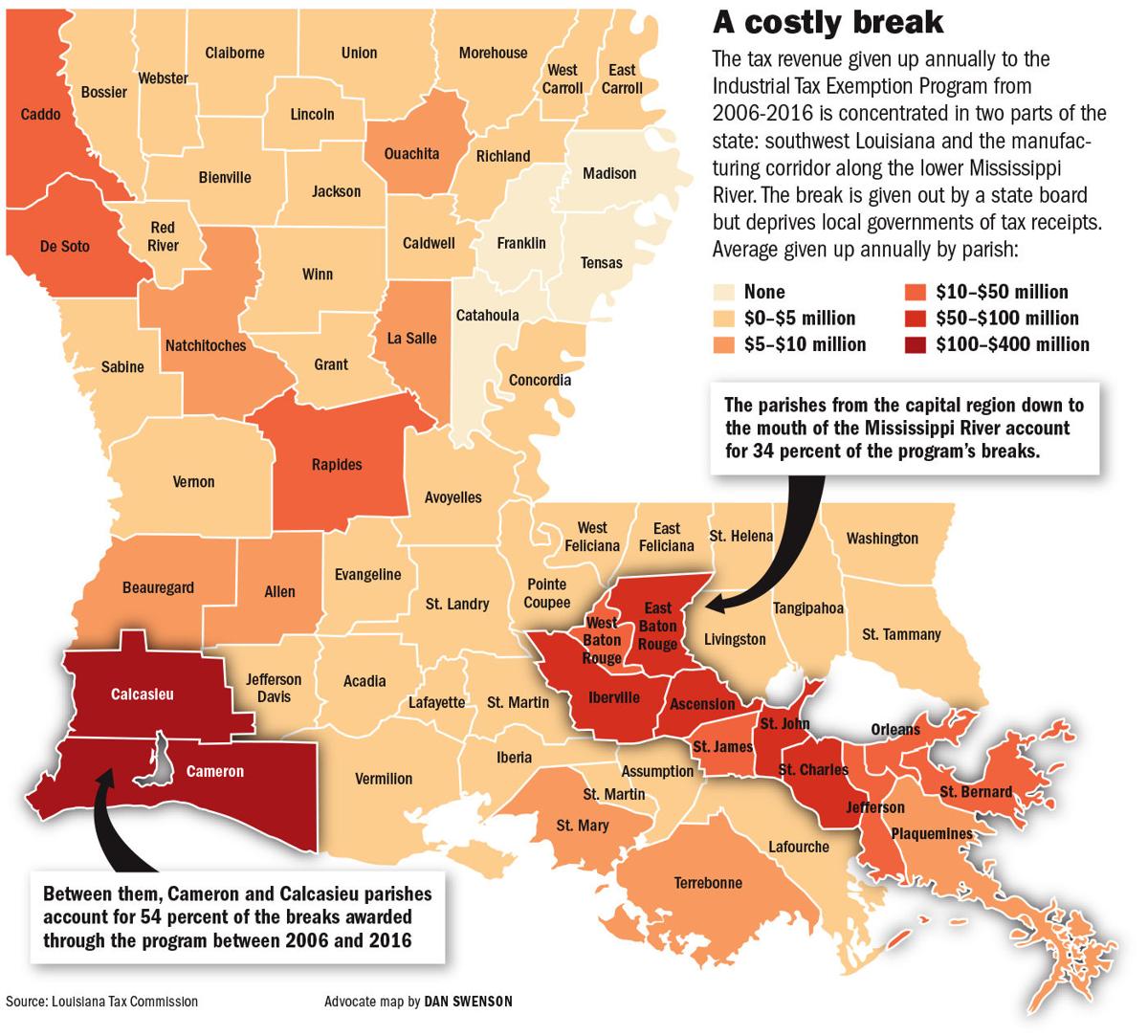

Why Louisiana Isn T The Petrochemical Silicon Valley Of The United States Via Nola Vie

Jefferson Parish Sheriff La Official Website Official Website

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

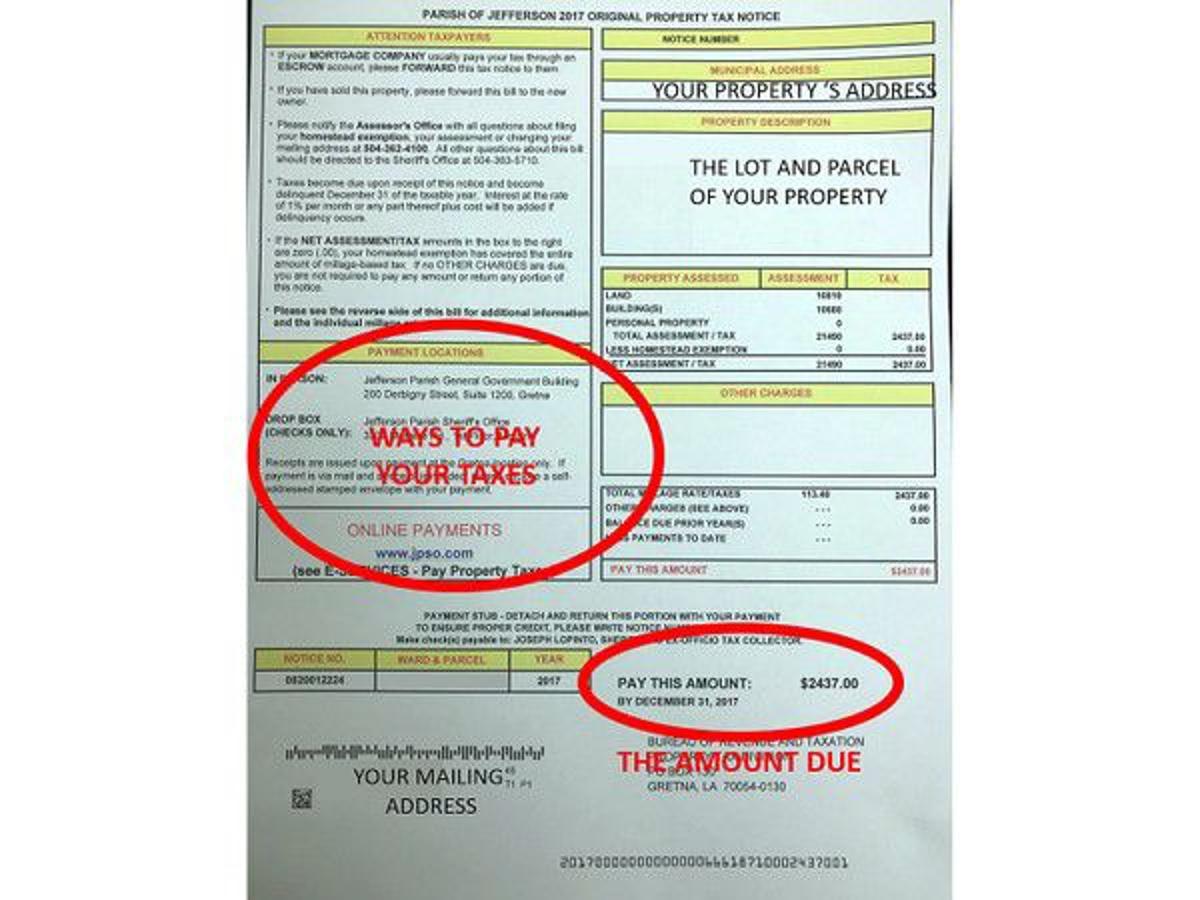

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

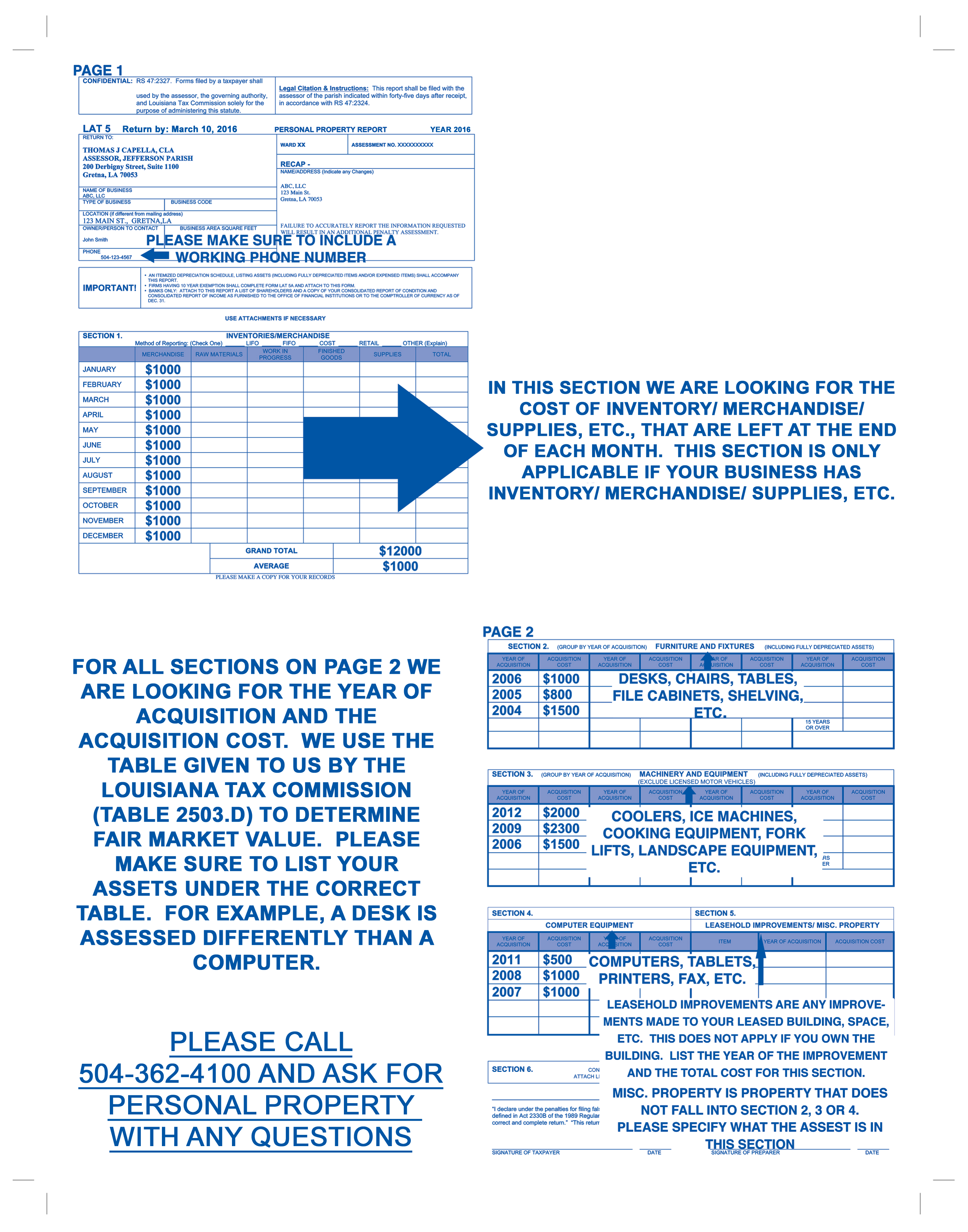

What Jp Residents Need To Know To Pay Property Tax

Breaking Down 1 25 Billion In Orleans Parish Tax Revenue

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Payments Jefferson Parish Sheriff La Official Website

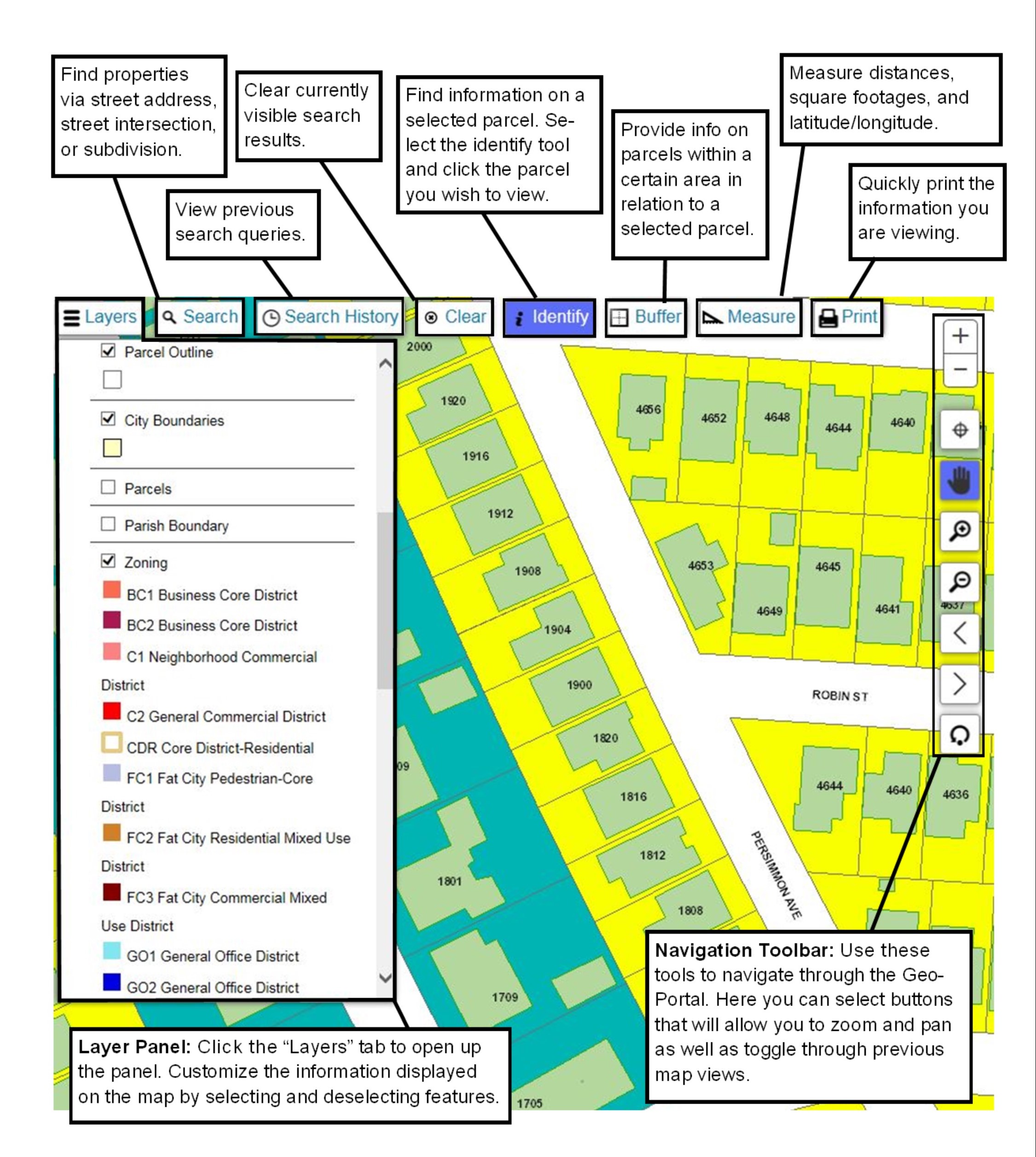

Jefferson Parish Assessor S Office Millages Wards

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com

Jedco Releases Strategic Economic Development Plan For Jefferson Parish The New Orleans 100